How long will it take me to Find and Buy a Home?

Posted on Mar 29, 2021 in BUYERS

Your Ultimate Guide to Buying a Home - From Calling your Buying Realtor to Moving In Day. Don't worry if this timeline does not look like what you are looking at right now. Individuals and Circumstances vary. This is only a Guideline.

Baycrest On the Rise - Burke Mountain Community

Posted on Mar 28, 2021 in Pre Sales

Baycrest on the Rise is a collection of 67 three- to five-bedroom townhomes located on a gentle slope at the foot of Burke Mountain.

Developed by the Vancouver-based Woodbridge Homes, this brand new community will set future residents within minutes of outdoor activities and convenient amenities, all while surrounding them with the lush, natural bea...

Why you should get a Mortgage Pre-approval

Posted on Mar 26, 2021 in BUYERS

Getting a pre-approval is one of the best things you can do to simplify the process and give yourself more confidence in your buying power. A pre-approval lets you know how much you are able to borrow with minimal risk. But as with anything to do with mortgages, you’ll want to understand the pre-approval process before you get started.

There are man...

There are man...

Overview: Sharia Financing or Islamic Financing

Posted on Mar 25, 2021 in Financing

Islamic banking or Islamic finance (Arabic: مصرفية إسلامية) or sharia-compliant finance is banking or financing activity that complies with sharia (Islamic law) and its practical application through the development of Islamic economics.

Some of the modes of Islamic banking/finance include Mudarabah (profit-sharing and loss-bearing), Wadiah (safekee...

Rocklin On the Creek Townhomes - Burke Mountain Community

Posted on Mar 24, 2021 in Pre Sales

Rocklin on the creek is a community with a peaceful creek flowing through the center. The architecture is timeless Georgian style, and the interiors are master planned to maximize on storage and space. Located at the foot of Burke Mountain, a rapidly growing family-oriented community with trails, paths, parks and shops.

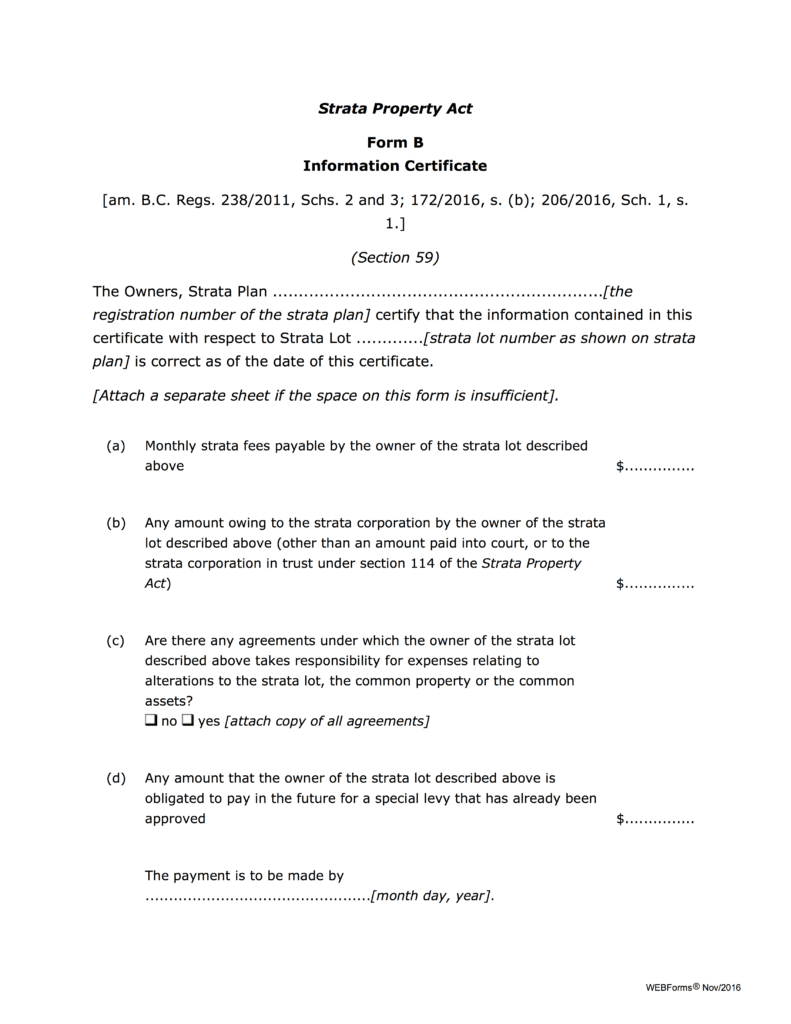

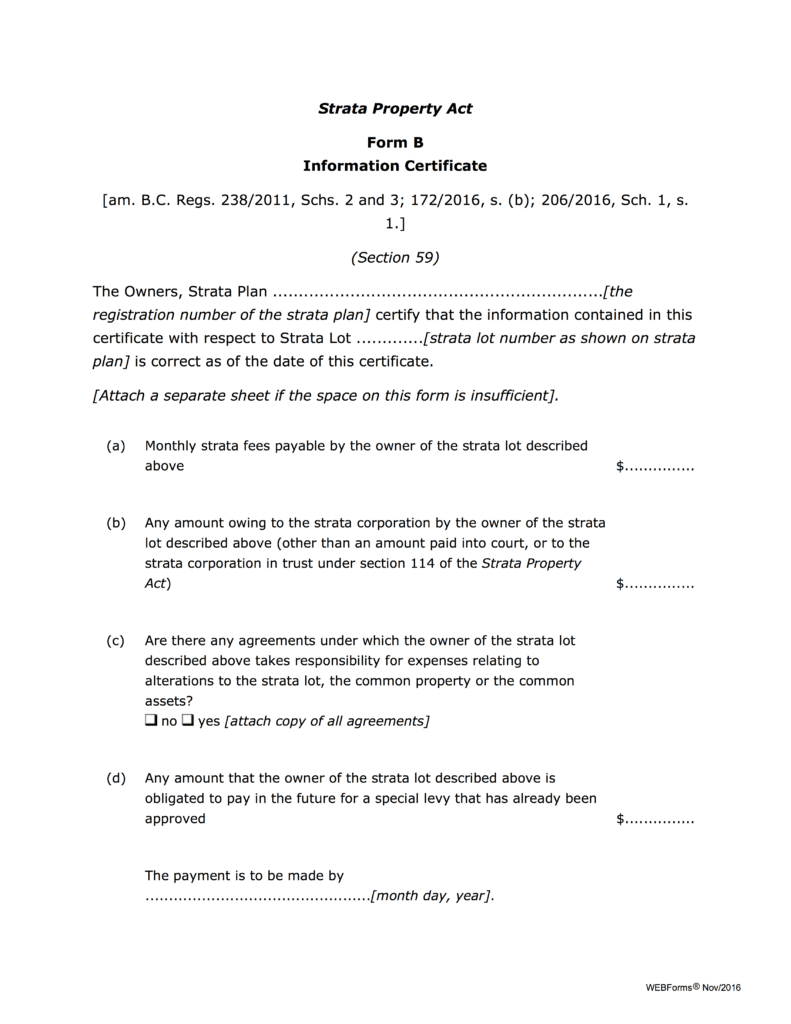

How to read the Form B - Depreciation Report

Posted on Mar 22, 2021

An owner, purchaser or person authorized by the owner or purchaser may request a Form B. The strata corporation is required to provide the Form B: Information Certificate within 7 days of a request.

The following information with respect to the strata corporation and the strata lot must be dis...

INFORMATION DISCLOSED - What will you find in the Form B.

The following information with respect to the strata corporation and the strata lot must be dis...