First time Home buyers/owners - Buying Home Insurance....Is it worth it?

Posted on May 31, 2017

So you've decided to purchase a new home. Congratulations!.While shopping for the perfect mortgage terms, don't forget to shop around for the perfect homeowner insurance. Homeowner insurance is not cheap but you will sleep better knowing you have it.There is no need to settle for inferior homeowners coverage. If you use the tips below, you can purc...

How to Cut Down on Pool Maintenance Costs This Summer

Posted on May 31, 2017

Pool maintenance doesn’t have to be an expensive annual chore. Rather than spending up to $700 on pool maintenance, you can cut costs by doing a lot of the work yourself. You don’t want the pool to fall into such poor shape that you have to spend thousands of dollars on repairs. Here are some steps to keep pool maintenance costs down to nearly none...

Real Estate Market Reports for your Neighborhood.

Posted on May 11, 2017

Market Reports for your Neighborhood.

Want to see what's happening in Real Estate in your neighborhood.

Here are reports for Burnaby, Coquitlam, Port Moody and New Westminster. Don't see your neighborhood but you'd like to know what the prices are like...Email me at lolaoduwole@yahoo.ca or Message me on FB....

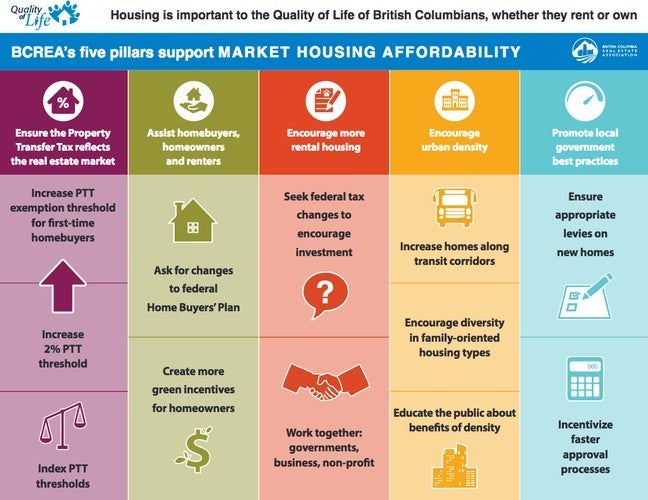

BCREA addresses Housing Affordability

Posted on Apr 25, 2017

Realtors are not the problem with affordability as most people would like to believe. Most of us have concerns about rising housing prices and we are fully aware that the reality of owning a home is becoming increasingly distant and out of reach for the average consumer .

Most of us actually care very strongly for our clients.

Realtors believe that i...

9 Pieces of Advice from Actual Owners for Buying a Vacation Home

Posted on Apr 24, 2017

Have you ever been on vacation and fallen head over heels in love with your surroundings?

Heck, I’m betting a question has popped into your head at some point: what if I bought a home here?.

Coldwell Banker Global Luxury

Posted on Apr 13, 2017

The modern expression of luxury real estate, Coldwell Banker Global Luxury aligns the power and recognition of the Coldwell Banker brand with the experience and stellar reputation of an unmatched agent base to consistently exceed the expectations of even the most discerning clientele.

The modern expression of luxury real estate, Coldwell Banker Global Luxury aligns the power and recognition of the Coldwell Banker brand with the experience and stellar reputation of an unmatched agent base to consistently exceed the expectations of even the most discerning clientele. Coldwell Banker is recognized around the world for leadership and...