Cher Lists Tudor home for $2.499m

Posted on Jul 23, 2018

https://www.mansionglobal.com/articles/cher-lists-tudor-revival-home-in-los-angeles-for-2-499-million-103641

The home features a rustic timber facade typical of Tudor-era cottages in the English countryside—though this Southern California home was built in 1957 and was recently remodeled, the listing says.

She bought the home through a private trust...

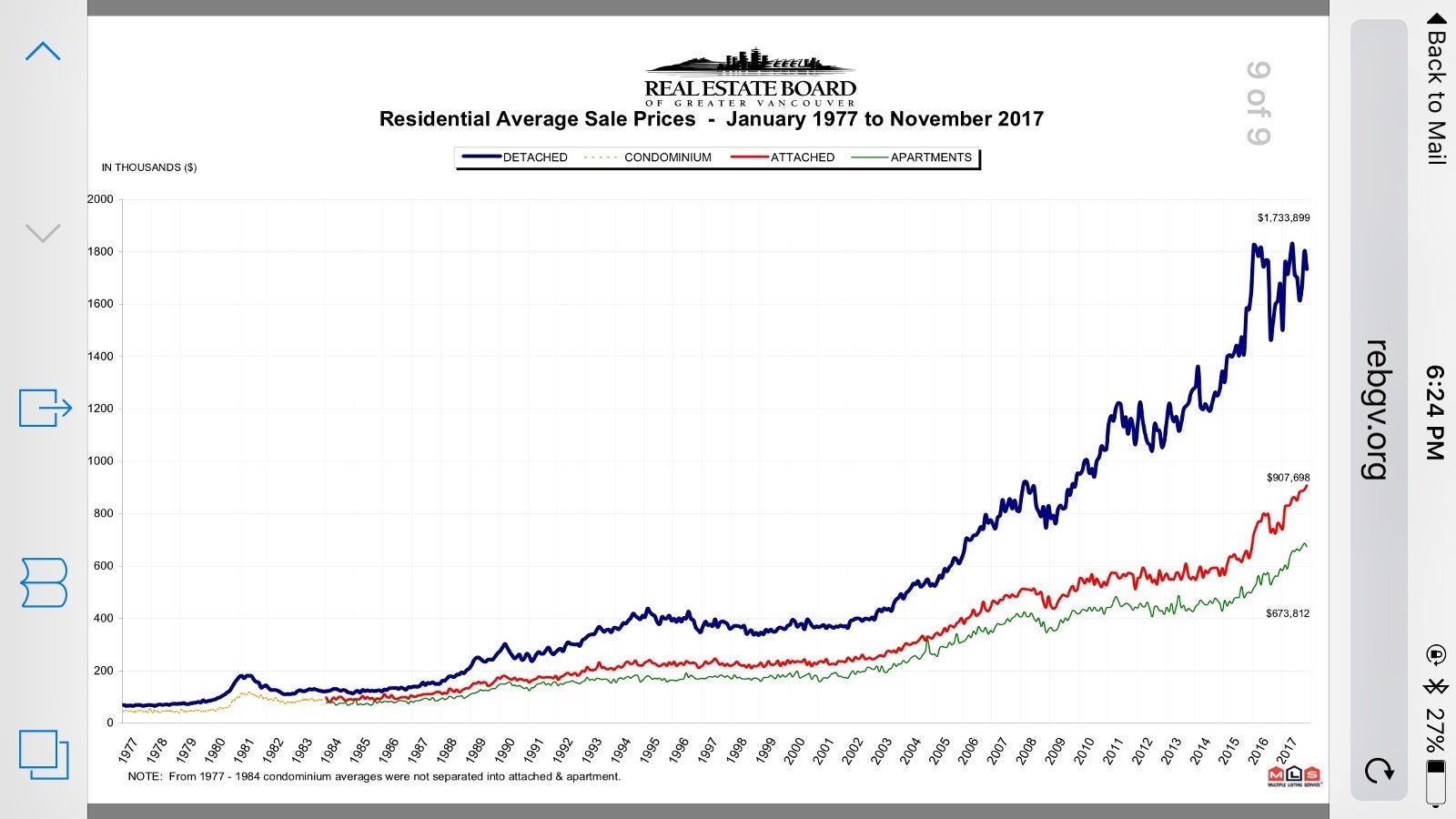

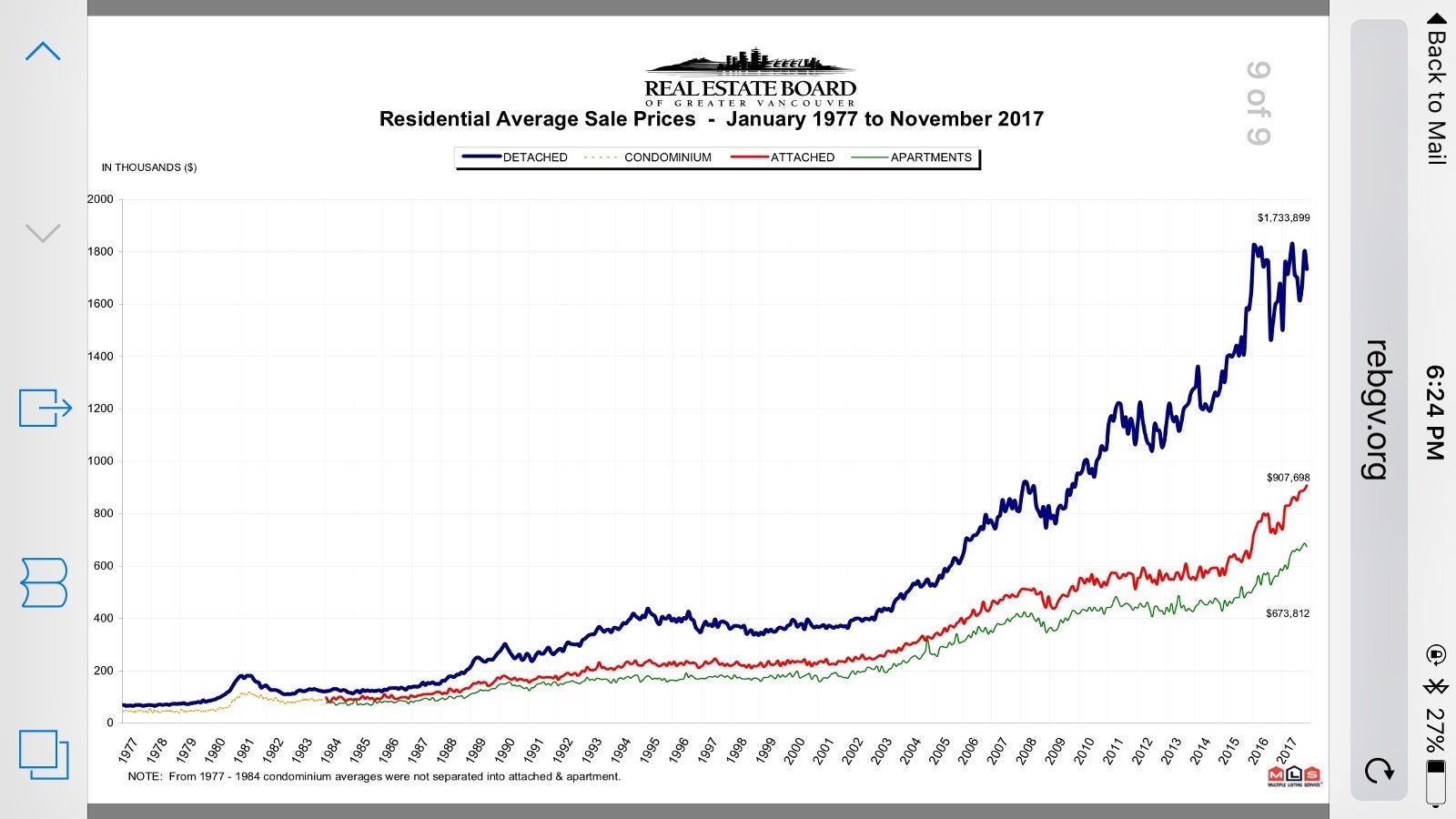

REAL ESTATE STATS - December 2017

Posted on Jan 02, 2018

Steady sales and diminished listings characterize 2017 for the Metro Vancouver housing market

After reaching record levels in 2015 and 2016, Metro Vancouver home sales returned to more historically normal levels in 2017. Home listings, on the other hand, came in several thousand units below typical activity. The Real Estate Board of Greater Vancouve...

Metro Vancouver continues to experience above-average demand and below-average supply

Posted on Dec 05, 2017 in Housing Market Report

Metro Vancouver* saw modest home listing changes and steady demand in November. The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,795 in November 2017, a 26.2 per cent increase from the 2,214 sales recorded in November 2016, and a 7.5 per cent decrease compared to October 2017 when 3,022...

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,795 in November 2017, a 26.2 per cent increase from the 2,214 sales recorded in November 2016, and a 7.5 per cent decrease compared to October 2017 when 3,022...

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,795 in November 2017, a 26.2 per cent increase from the 2,214 sales recorded in November 2016, and a 7.5 per cent decrease compared to October 2017 when 3,022...

The Real Estate Board of Greater Vancouver (REBGV) reports that residential home sales in the region totalled 2,795 in November 2017, a 26.2 per cent increase from the 2,214 sales recorded in November 2016, and a 7.5 per cent decrease compared to October 2017 when 3,022...Buying Your First Home? Make Sure You’re Financially Prepared With These Steps

Posted on Nov 25, 2017 in BUYERS

Buying your first home can be one of the most exhilarating — and stressful — moments of your life. But armed with the right information, you can shop for a house, apply for a mortgage, and close the deal with confidence.

Step 1: Determine how much house you can afford

The first thing to do before buying a home is to make sure it’s the right time to d...

The Intersection of Fine Art and Real Estate

Posted on Nov 16, 2017

By now, you have heard the news about the only Leonardo Da Vinci painting in private hands - Salvatore Mundi (previously thought to be a copy and purchased for $45) which sold for $450,000,000 which includes buyers premiums and taxes etc.

Dubbed the male Mona Lisa and once owned by King Charles I, the piece was one of the last to be re-discovered in...