Moving to a new province? Here’s how to relocate like a pro

Posted on Mar 29, 2025 in Real Estate and Lifestyle

Relocating to a new province is an exciting adventure, but it can also feel overwhelming. Whether you’re moving for work, a change of pace, or new opportunities, planning ahead is key to making your transition as seamless as possible.

Research your new province

Before making your move, spend time learning about your new province. Understanding the...📉 Interest Rate Drop in Canada – What It Means for You!

Posted on Mar 13, 2025 in Real Estate and Lifestyle

📉 Interest Rate Drop in Canada – What It Means for You! 🏡💰

On March 12th, the Bank of Canada announced that it had lowered the target for the overnight lending rate by 25 basis points to 2.75%. This marks the seventh consecutive decrease to rates since June 2024.

In recent months, the pervasive uncertainty created by continuously changing US tariff...

On March 12th, the Bank of Canada announced that it had lowered the target for the overnight lending rate by 25 basis points to 2.75%. This marks the seventh consecutive decrease to rates since June 2024.

In recent months, the pervasive uncertainty created by continuously changing US tariff...

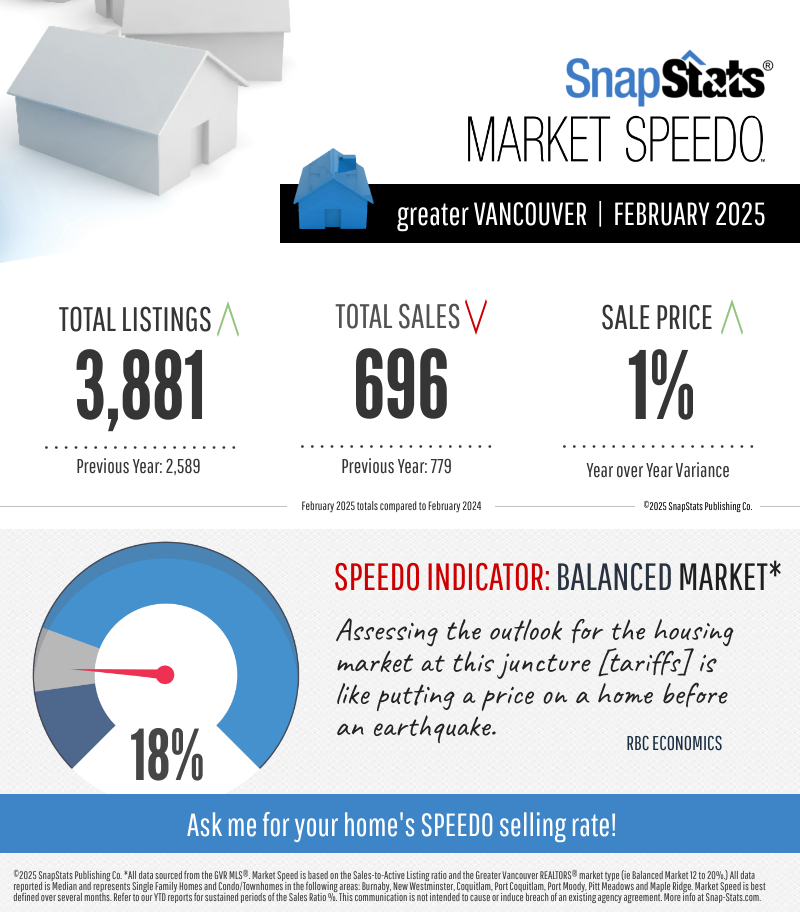

FEBRUARY GTA - Monthly Market Report

Posted on Mar 06, 2025 in Real Estate and Lifestyle

📊 February 2025 GTA Housing Market Update 🏡In February, the Greater Toronto Area (GTA) experienced a notable shift in the housing market:

- Home Sales: Declined by 28.5% compared to January, following a 12.4% increase in the previous month. Year-over-year, sales dropped by 27.4%. reuters.com

- New Listings: Seasonally adjusted new listings decreased by...

SPRING OPENING CHECKLIST. Get your Cottage ready for the season.

Posted on Feb 28, 2025 in Real Estate and Lifestyle

As the weather warms up, it's time to open up your cottage or cabin for another season of relaxation and outdoor fun. To make the transition seamless, follow this step-by-step checklist to ensure everything is in top shape before summer begins!

✅ Essential Spring Cottage Opening Checklist

✅ Essential Spring Cottage Opening Checklist

1️⃣ Restore Utilities – Before heading up, contact utility pro...

✅ Essential Spring Cottage Opening Checklist

✅ Essential Spring Cottage Opening Checklist1️⃣ Restore Utilities – Before heading up, contact utility pro...