Contract Of Purchase and Sale

- DEPOSIT - Not to be confused with your down payment, a deposit is essentially an offer of good faith to the seller that you are serious about purchasing their home – even though you still want to get a home inspection and your mortgage financing in place, before signing on the dotted line.

- COMPLETION - The completion date is the day that the buyer assumes title at Land Title Office. This is the day that closing costs and monies are due.

- ADJUSTMENT - The adjustment date is the day that the buyer assumes and is responsible for all taxes, utilities, rates, and assessments. This date is typically the same day as the possession day.

- POSSESSION - The possession date is the day that the buyer will have possession of the property.

In the contract you will also have to specify a time that you will take possession, and whether you will have vacant possession or if existing tenancies will remain. - TITLE-What is a title in Real Estate ?

Title is a legal term meaning registered owner of real property. When your lawyer is preparing to transfer the title to your property, you will likely be asked who will actually own it. You may choose to list one name alone, fellow investors (a parent, for example) or, particularly in a marriage, both spouses. The issue of whose name is on the title is frequently important when one individual is putting up most or all of the money for the purchase. Title can also be held by other than individuals, such as partnerships and corporations. - BUYERS COSTS

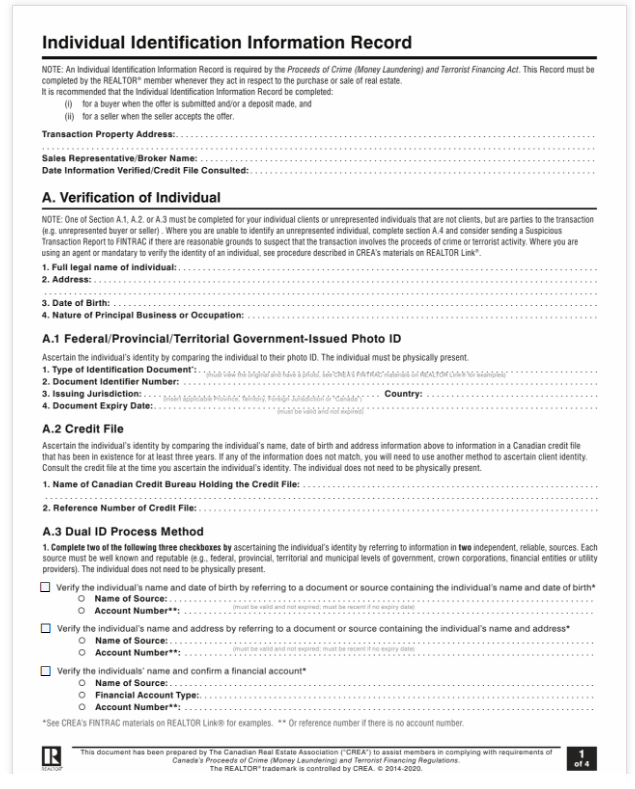

- RESIDENCY - International Sellers and Buyers must disclose their Residency

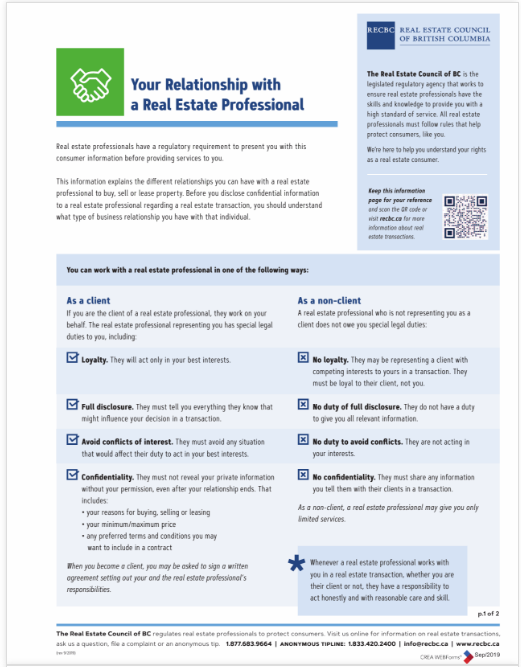

- AGENCY DISCLOSURE - This is the section where you acknowledge who your chosen representation is. In this section, both the seller’s and buyer’s agents will be listed.

If you are choosing to be unrepresented or have an agent perform dual agency, you will have to initial off on it and also refer to the updated Real Estate Council form acknowledging the risks of this.