Annual property tax

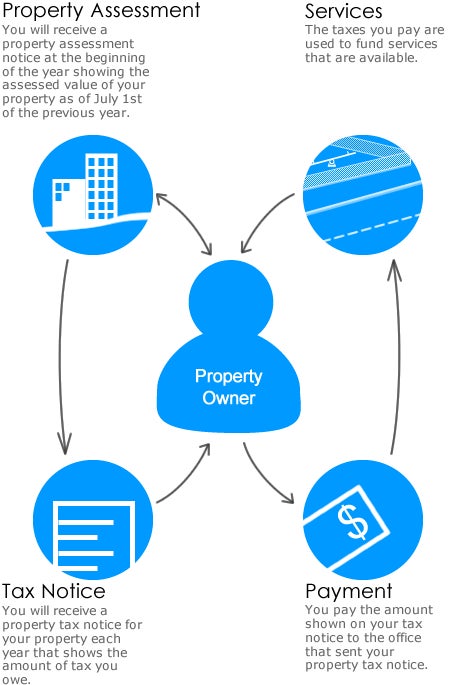

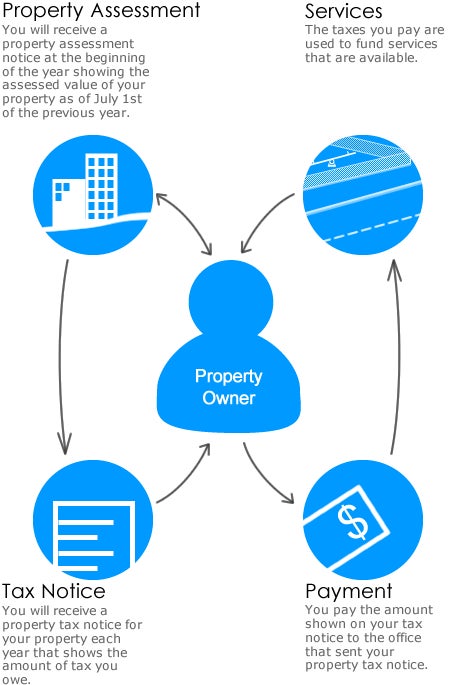

Generally, every property owner in Canada must pay property taxes. If your property is located in a city, town, district or village, it is in a municipality. You will receive your property tax notice from your municipality and pay your property taxes to your municipal office.

For example, if the market value of your home is $325,000 and your municipality’s property tax rate is 1.5%, your property taxes would be:

When you own or lease a property or manufactured home in B.C., property taxes must be paid yearly for each property.

Generally, every property owner in Canada must pay property taxes. If your property is located in a city, town, district or village, it is in a municipality. You will receive your property tax notice from your municipality and pay your property taxes to your municipal office.

When a community starts a new service they are responsible for the costs. In some cases, the cost for the new service may be shared with other nearby communities. A recreation facility is a good example of when the cost to provide a new service may be shared.

The money raised from property taxes is used to fund local programs and services, such as:

- Police and fire protection

- Emergency rescue services

- Road construction and maintenance

- Garbage collection and Services

- Water and sewer services

- Recreation and community centres

- Parks and leisure facilities

- Parks

- Libraries

- Schools

- Hospitals

How much property tax do I have to pay?

The amount you pay is based on the funds needed to provide services for the year. Tax rates are set to determine how to share the cost of providing the services.Tax rates and your property assessment determine how much property tax you pay.

How are property taxes calculated?

Once a year, municipalities across the country assess and determine their property tax rate, which is usually somewhere in the range of 0.5 to 2.5%. Some people assume their annual property taxes are based on the size of their property, but that’s not exactly true. Your municipality’s property tax rate is multiplied by the market value of your home (not the purchase price), which can vary year-to-year based on the value of surrounding properties.For example, if the market value of your home is $325,000 and your municipality’s property tax rate is 1.5%, your property taxes would be:

So you would owe $4,875 in property taxes to your municipality that year.

What if the seller has prepaid their property taxes?

When you buy your home, your real estate lawyer will do the legwork to make sure all of the seller’s expenses are up-to-date, including their property taxes.If they are not, the seller will be required to pay them to the municipality. On the other hand, if the seller has prepaid their property taxes for the entire year, you’ll need to reimburse them a prorated amount, from your closing date to the day they’ve paid up until.

That amount would then be listed on your Statement of Adjustments, and must be paid for with cash on closing day.

If you like this post and other posts we write...don't forget to sign Up here for our Newsletter HERE.

Property taxes in municipalities

If your property is located in a city, town, district or village, it is in a municipality. When you own property in a municipality, you will receive your property tax notice from your municipality. You pay your property taxes to your municipal office.Your municipality collects taxes for the services they provide and on behalf of other organizations to raise funds for services. Some of the organizations your municipality may collect taxes on behalf of are:

- Provincial Government (school and policing)

- Regional Districts

- Regional Hospital Districts

- British Columbia Transit Authority

- TransLink

- BC Assessment

- Municipal Finance Authority

If you like this post and other posts we write...don't forget to sign Up here for our Newsletter HERE.